Why you should invest in an Identity Verification (IDV) solution for your business?

#IDV #CTF #AML

Are you losing good customers to a cumbersome onboarding process? Do you want to stay ahead of potential data breaches and risks of farming out the customer verification process to third-party vendors? Does your business belong to an industry like “Gambling and Casinos” that has age limitations? Do you conduct cross-border business and need to know who you are doing business with? Is your business a regulated industry that requires you to implement compliance based on the geography?

Well, now you no longer need to be concerned. Whether you are a Cryptocurrency business that needs to know the nationality of your customer, or a P2P micro lending firm wanting to validate address, you can now verify and validate the documents received during customer onboarding. Identity Verification is the new kid on the block, serving all your identity proofing needs.

According to Gartner, “high confidence in the identity of customers” is very important for a robust fraud management programme. In its Market Guide for Identity Proofing and Corroboration Report, Gartner mentions that 32% of enterprises are concerned about identity theft and frauds arising in the new account creation processes; while 23% have concerns about fraud by account impersonation. This has led to the practice of identity verification to ensure the trustworthiness of a consumer’s identity, and corroborate that the customer is who he says he is.

These concerns have been further exacerbated by reports of breaches that revealed names, addresses, government identifiers, and more, arising from manual or third-party processes. Thus companies in verticals like banking, finance and insurance, healthcare, government, education, retail, and telecom; are attempting to reduce their reliance on potentially compromised personally identifiable information (PII) by using SaaS-based automated IDV services.

Identity Verification (IDV) is an automated service for identity proofing and customer authentication provided to companies with anti-money laundering obligations and risk compliance programmes, as mandated by the nature of their business or industry.

IDV includes the verification and validation of the following, where the customer is an individual or an entity:

This authenticates Proof of Address, and helps to prevent customer fraud by ensuring evidence of existence.

Documents provided by customers as part of the KYC or onboarding process are verified in real-time through a restful API.

These include:

To ensure interoperability across multiple systems and countries, IDV services support:

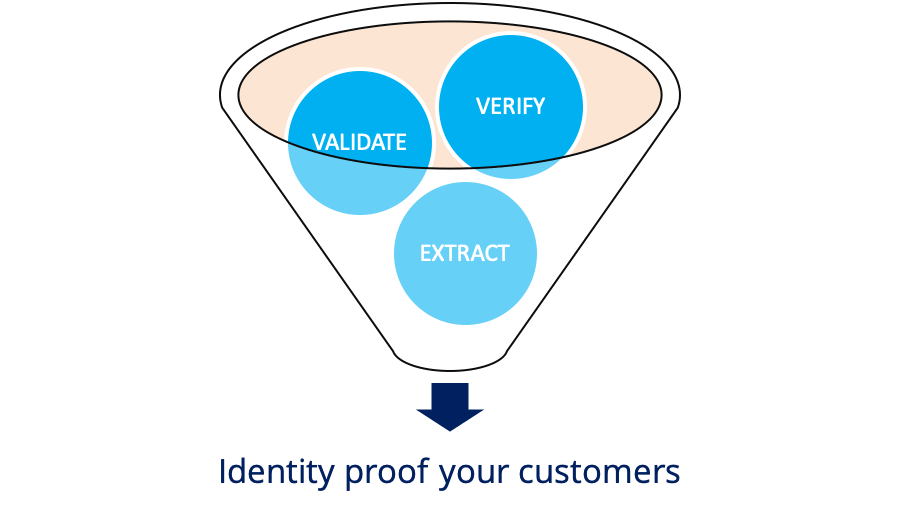

What does the process of IDV entail?

Capture: ID documents are scanned.

Extract: Customer Identity Information is extracted using advanced technologies.

Screen: ID documents are verified using real-time online checks from available databases.

Information Extraction and Export: Verified details extracted from various documents are sent to the client via the API.

Whether you are a financial institution, a Trust Body or a regulated entity, you need to comply with the norms. This means balancing customer satisfaction and fraud prevention, best achieved through a frictionless automated solution.

which are able to assess the identity of a user not only by relying on digital credentials, but also by rounding off and enhancing this assessment through the continuous, comprehensive use of other sources or signals within their context.

Why your business or organisation must use an IDV service:

The benefits of deploying a dynamic risk-based IDV service that identity proofs a customer through technology use helps maintain high levels of compliance.

The benefits of deploying a dynamic risk-based IDV service that identity proofs a customer through technology use helps maintain high levels of compliance.