Customer Identity Verification

Smart, Simple &

Reliable Identity Verification

Reduce the time and effort associated with sighting and collecting physical copies of IDs by verifying them against their issuing sources using MemberCheck’s ID Verification service.

Trusted By:

Streamlined Process

Prior to onboarding, send your clients an Email/SMS to enter in their personal information and verify their identity.

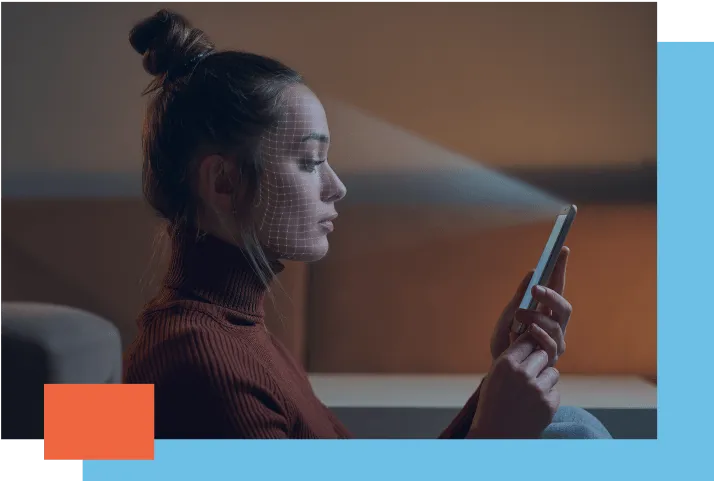

Biometric Screening

Utilise FaceMatch, facial recognition, and liveness detection technology to biometrically verify your customers.

All-in-One Solution

Combine ID verification with anti money laundering screening to obtain a comprehensive profile of your customer.

Pass/Fail Result

Your customers that have been successfully verified will obtain a pass result. Failed results may require additional investigation.

Automate Annual Process

Integrate with MemberCheck's RESTful API and automate your ID Verification processes.

Updated Information

Each data source is updated daily, and each scan is performed in real time to ensure that you obtain the most up-to-date information possible.

A global company that thinks local

Positioning services globally, MemberCheck aids organisations in enhancing compliance with local laws and standards.

Benefits:

Improved Performance

Positioning our resources closer to you allows us to enhance request processing. This proximity guarantees faster responses, reduces delays, and boosts the efficiency of your operations.

Enhanced Security

Protecting your data is our utmost priority. Processing and storing it within specific regions enhances access control and ensures compliance with local regulations. This method ensures your data remains both secure and compliant.

Assured Compliance

Compliance is essential. Our method of local deployment is designed to harmonise with regional laws, notably directives like GDPR. This concentrated approach ensures that entities smoothly conform to legal norms.

Global & Regional Services

America

(Planned)

Germany

(Global Service)

Australia

(Global Service)

Indonesia

(Global Service)

Oman

(Regional Service)

South Africa

(Planned)

Current Deployments

Upcoming Deployments

Australia

Germany

Oman

Indonesia

Upcoming Deployments

America

South Africa

If you are interested in learning more about our services, please do not hesitate to contact us. Our team would be happy to discuss your specific needs and provide guidance on the best solutions for your business.

What is IDV?

IDV is a service used to check that the customers you are doing business with are providing you with genuine documents to verify their identity. Using an IDV service helps you to meet Know Your Customer (KYC) and AML/CTF obligations. KYC is an important process for businesses and agencies to protect themselves from corruption and fraud.

Perform a PEP & Sanction check together with an ID Verification check in one scan

Intuitive and accessible interface for requesting and reviewing ID Verification results

Sensitive data is stored securely inline with ISO27001 standards

Downloadable reports for auditing purposes

High ID Verification Rates (95%)

Transparent pricing models

Real-time verification

Global Coverage

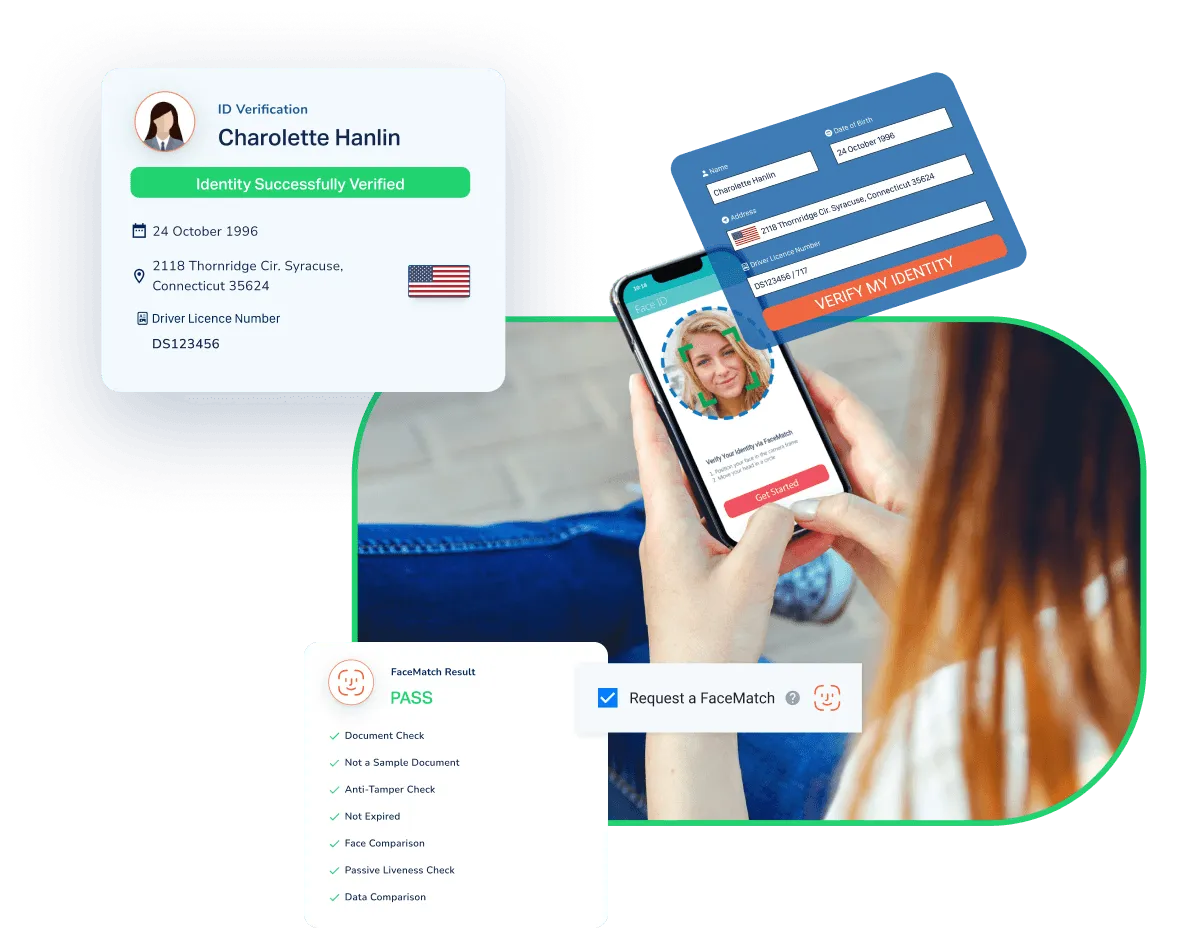

Request DemoHow does MemberCheck's ID Verification solution work?

MemberCheck sends a SMS to your customer

Your customer enters their personal information and takes photos of their ID documents

If you request a FaceMatch, your customer will be required to take a selfie

MemberCheck verifies your customer’s name, DOB, and address against multiple data sources

Liveness, OCR and facial recognition are run if FaceMatch is requested

Within seconds you are provided with the results

Our ID Verification Coverage

Instantly verify your customer’s ID from any of the countries mentioned.

Why do you need ID Verification?

IDV is a service used by businesses to check documents shared by their customers they conduct business with. ID Verification helps protect business from fraud but identifying the legitimacy of the documents shared by customers. Having an IDV program in place allows companies to comply with Know Your Customer (KYC) and AML/CTF legislation.

FRAUD PREVENTION

IDV is an important component of KYC to ensure you know who you are dealing with and to avoid potential financial and reputational risk to your business.

COMPLIANCE

Comply with AML/CTF regulations by verifying the identity of your new and existing customers and avoiding the consequences of non-compliance.

COMPLIANCE

Streamline your onboarding process with identity verification in real time with instant results.