Who are The United Kingdom’s AML/CTF Supervisors?

FCA, HMRC, the Gambling Commission and 22 other professional bodies act as supervisory authorities under POCA (primary AML regulation) and the Regulations.

Financial Conduct Authority - (FCA)

Financial Conduct Authority is the UK’s main financial services regulator with authority over banks, building societies, credit unions and other firms engaging in financial activities. FCA is in charge of ensuring that AML requirements are followed. FCA has the authority to investigate money laundering and terrorism financing offenses in collaboration with other law enforcement agencies and authorities, such as the Crown Prosecution Service (CPS).

Her Majesty’s Revenue and Customs (HMRC)

Together with FCA, they are responsible for investigating money laundering charges. HMRC provides guidance on anti-money laundering, including compliance requirements for customer due diligence and transaction monitoring as well as the necessity to issue an anti-money laundering policy statement.

Additionally, NCA (National Crime Agency) and SFO (Serious Fraud Office) have the power to enforce money laundering regulations, arrest and can seek warrants and court orders, freeze and confiscate assets that they suspect are involved in money laundering, terrorism financing or other criminal activities.

The Office for Professional Body Anti-Money Laundering Supervision (OMBAS) is in charge of increasing the consistency of AML supervision by professional bodies.

How to Comply with AML/CTF Regulations in The United Kingdom?

Regulated businesses are requested to take a risk based approach to the threats they are exposed to. The risk based approach should cover:

- Risk assessment which identifies and assesses the risk of money laundering and terrorism financing to its business

- AML/CTF Compliance Programme

- Conduct an assessment of money laundering and terrorism financing risks

- Controls and procedures to effectively manage risks

- Apply Customer Due Diligence measures

- Designate a Money Laundering Reporting Officer

- AML/CTF training to employees

Additionally, there are obligations under POCA to make a SAR whenever a person knows, suspects or has reasonable grounds to believe that another person is engaged in money laundering.

FCA has authorised a FCA Handbook that requires financial institutions, authorised by FCA, to establish and maintain effective systems and controls for countering financial crime risk. The FCA Handbook also includes requirements regarding AML compliance.

Additional information about the FCA Handbook: https://www.handbook.fca.org.uk/handbook

What are my AML/CTF Reporting Obligations?

Those entities regulated under POCA have the obligation to report suspicious activity whenever:

The person knows or suspects that another person is involved in money laundering, or has reasonable grounds to believe that another person is involved in money laundering.

The knowledge or suspicion is based on information obtained in the course of conducting business in the regulated industry.

The person can identify the other person or the whereabouts of the laundered property, or they believe or it is reasonable to expect them to believe that the information will or may help in identifying that other person or the whereabouts of any of the laundered property.

How can MemberCheck Help?

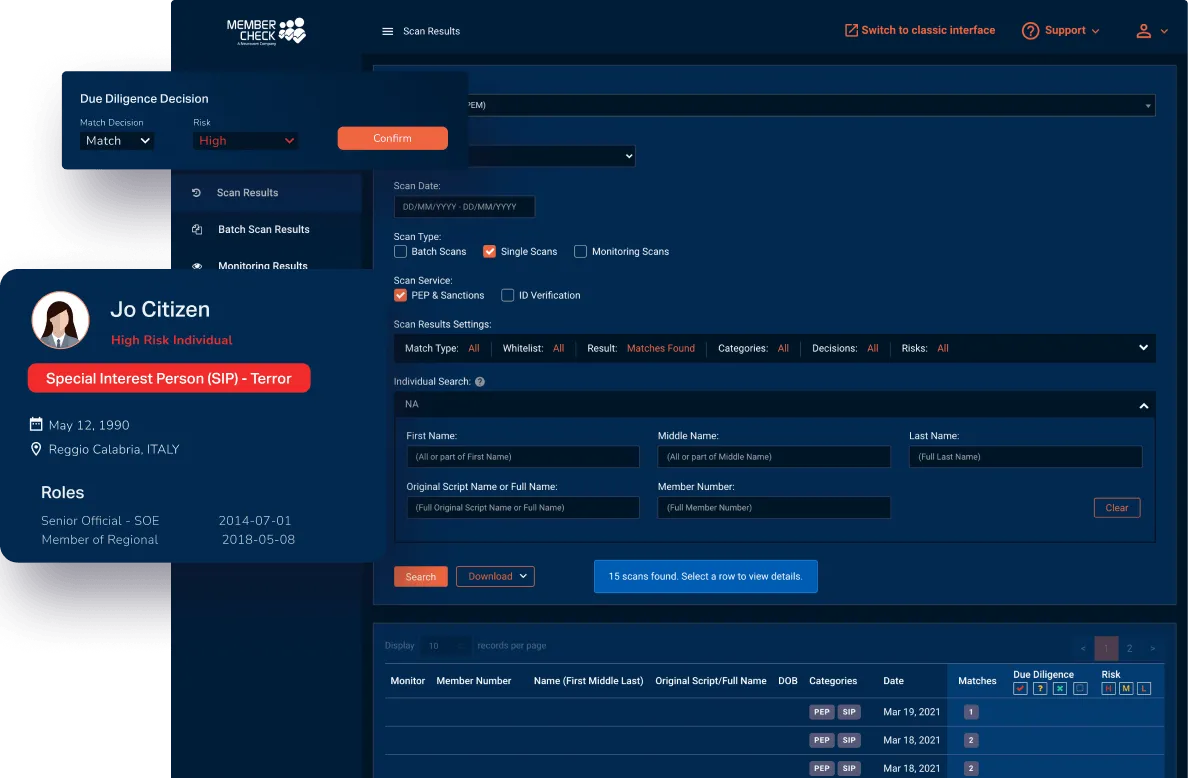

Our clients are provided with a secure and simple solution in regard to scanning for politically exposed or high-risk individuals, as well as checking names against sanction, regulatory, law enforcement, and other official lists.

Use our sophisticated scan filters and due diligence workflow to minimise the amount of time you spend sorting through, false matches. Scan results and reporting sections allow you to access customer details, whenever and wherever required, as well as download reports, to customise for further investigation or to provide evidence of your AML program compliance for auditing purposes.

* This page is intended as general information only and should not be relied on as the sole source of information for your AML obligations and AML program. Please visit your local regulatory authority sites for the latest relevant and full information.