AML/CFT Supervisors in Philippines

The Anti Money Laundering Council (AMLC)

The Anti Money Laundering Council (AMLC) is the Philippines’ Financial Intelligence Unit (FIU) tasked to implement the Anti Money Laundering Act and the Terrorism Financing Prevention and Suppression Act.

The Supervisory Authorities are the Bangko Sentral ng [SS1] Pilipinas, the Securities and Exchange Commission, the Insurance Commission, or other government agencies designated by law to supervise or regulate a particular financial institution or Designated Non-Financial Business and Profession.

How to comply with AML/CTF regulations in Philippines?

The Anti Money Laundering Act (Republic Act No. 9160) and its implementing regulations establish a series of duties for covered persons. These include:

Duty to carry out an institutional risk assessment to identify, assess, and understand the ML/TF risks.

Duty to develop sound risk management policies, controls, and procedures to manage and mitigate the ML/TF risks identified; monitor the implementation of those controls; enhance them or reduce them when risks are higher or lower, respectively.

Duty to formulate and implement a comprehensive and risk-based ML/TF Prevention Program. The Program shall include, at the minimum, internal policies, controls, and procedures on the following:

- Risk management.

- Compliance management setup, including the designation of a compliance officer at the management level or creation of compliance unit.

- Screening procedures to ensure high standards when hiring employees.

- Continuing education and training programs.

- Independent audit functions.

- Details of implementation of customer due diligence, record-keeping and reporting requirements.

- Compliance with freeze, bank inquiry and asset preservation orders, and all directives of the AMLC.

- Adequate safeguards on the confidentiality and use of information exchange, including safeguards to prevent tipping-off.

- Cooperation with the AMLC and Supervisory Authorities.

Duty to carry out customer due diligence measures when:

- Establishing business or professional relationship.

- Carrying out occasional transactions above PHP 100,000 or any other threshold that may be determined by relevant supervisory authorities, including situations where the transaction is carried out in a single operation or in several operations that appear to be linked.

- Carrying out occasional wire transfers.

- There is a suspicion of ML/TF, regardless of any exemptions or thresholds.

- The covered person has doubts about the authenticity or adequacy of previously obtained identification information and/or data.

The customer due diligence measures include the following procedures:

- Customer identification process

- Customer verification process

- Identification and verification of agents

- Beneficial ownership verification

- Determination of the purpose of the relationship

- Ongoing monitoring process

Duty to carry out an enhanced due diligence in cases of higher risk and possibility of carrying out a reduce due diligence in cases of lower risk.

Duty to establish and record the true and full identity of PEPs, as well as their immediate family members and close relationships/associates, as well as carry out an enhanced due diligence.

Duty to maintain and safely store the dates of transactions all customer records and transaction documents for a minimum of 5 years.

Duty to keep all records obtained through customer due diligence, account files, business correspondence, and the results of any analysis undertaken, for at least, 5 years following the closure of the account, termination of the business or professional relationship, or after the date of the occasional transaction.

When they enter into any cash transaction whose value matches or surpasses the value stipulated by the Country AML Committee. Precious metal and previous stone merchants, as well as dealers who conduct high value transactions, must report suspicious transactions to the FFU.

When completing real estate sale or purchasing transactions for their consumers, real estate agents and brokers must report questionable transactions to the FFU.

No legal action may be taken against financial institutions or non-financial firms and professions, or their managers, officials, or employees, for the execution of a suspicious transaction reported in good faith in accordance with the country's AML regulation.

What are my AML/CTF reporting obligations?

Covered persons have the duty to report to the AMLC:

Covered transactions: A “covered transaction” refers to:

- A transaction in cash or other equivalent monetary instrument exceeding PHP 500,000.

- A transaction with or involving jewellery dealers, dealers in precious metals and dealers in precious stones in cash or other equivalent monetary instrument exceeding PHP 1,000,000.

- A casino cash transaction exceeding PHP 5,000,000 or its equivalent in other currency.

- A cash transaction with or involving real estate developers or brokers exceeding PHP 7,500,000 or its equivalent in any other currency.

Suspicious transactions: “Suspicious transactions” are transactions with covered persons, regardless of the amounts involved, where any of the following circumstances exist:

- There is no underlying legal or trade obligation, purpose, or economic justification.

- The client is not properly identified.

- The amount involved is not commensurate with the business or financial capacity of the client.

- Taking into account all known circumstances, it may be perceived that the client’s transaction is structured in order to avoid being the subject of the reporting requirements under the Act.

- Any circumstance relating to the transaction which is observed to deviate from the profile of the client and/or the client’s past transactions with the covered person.

- The transaction is in any way related to ML/TF or related unlawful activity that is about to be, is being or has been committed.

- Any transaction that is similar, comparable or identical to any of the foregoing.Any unsuccessful attempt to transact with a covered person, the denial of which is based on any of the foregoing circumstances, shall likewise be considered as suspicious transaction.

More information:

How can MemberCheck Help?

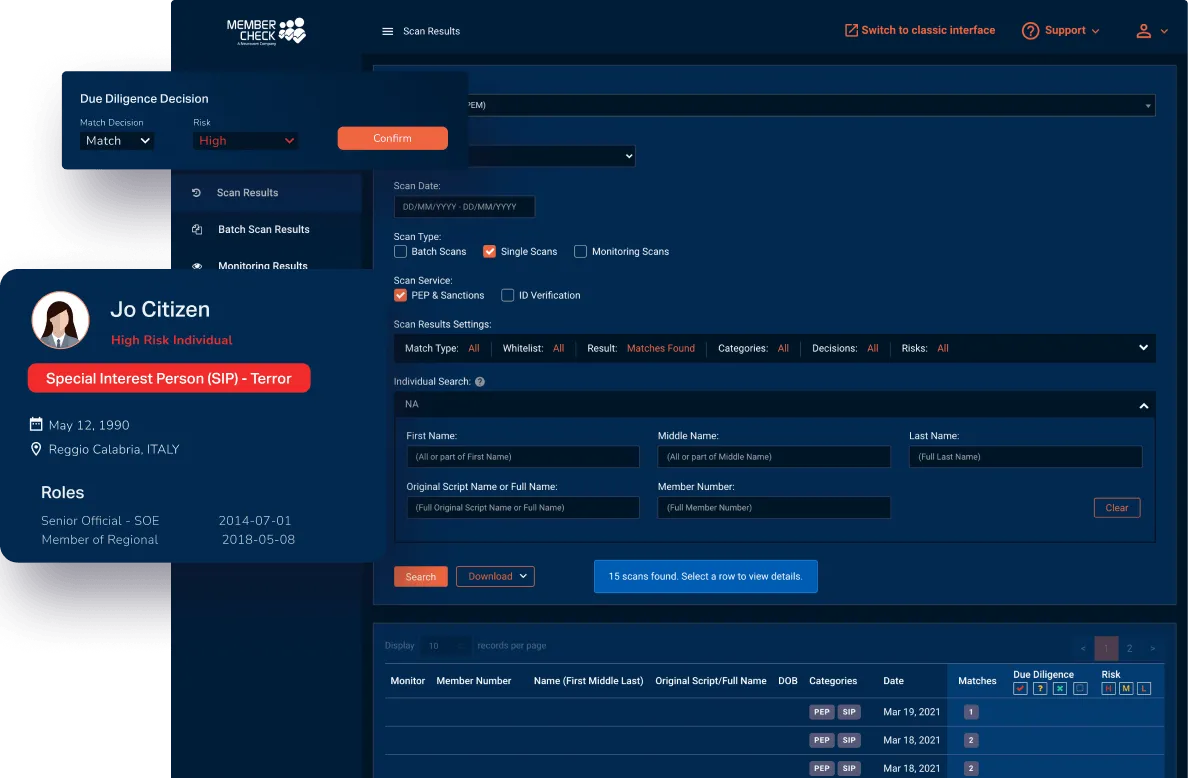

Our clients are provided with a secure and simple solution in regard to scanning for politically exposed or high-risk individuals, as well as checking names against sanction, regulatory, law enforcement, and other official lists.

Use our sophisticated scan filters and due diligence workflow to minimise the amount of time you spend sorting through, false matches. Scan results and reporting sections allow you to access customer details, whenever and wherever required, as well as download reports, to customise for further investigation or to provide evidence of your AML program compliance for auditing purposes.

* This page is intended as general information only and should not be relied on as the sole source of information for your AML obligations and AML program. Please visit your local regulatory authority sites for the latest relevant and full information.