AML/CFT Supervisors in Kenya

Directorate of Criminal Investigation (DCI)

The current functions of the Directorate General under theNational Police Law 2011 are:

Collecting and providing criminal information.

Conduct serious crime investigations such as manslaughter, drug-related crimes, human trafficking, money laundering, terrorism, white-collar crime, piracy, organized crime, and cybercrime.

Maintain law and order.

Crime detection and prevention.

Arrest of perpetrators.

Maintain a criminal record.

Conducting forensic analysis.

Carrying out instructions given to the Inspector General by the Attorney General pursuant to Article 157(4) of the Constitution.

Coordinate national Interpol operations.

Investigate matters referred by independent police inspectors.

Perform other functions assigned by other written law.

How to comply with the Directorate of Criminal Investigation in Kenya?

Financial Institutions (FIs) and DesignatedNon-Financial Institutions and Professionals (DNFBPs) must have and operate a compliance program that includes, but is not limited to:

Policies and procedures for sharing information on customer due diligence, money laundering and terrorist financing risks.

Mandatory provision of customer and facility information when required for AML/CFT purposes.

Analytical reports and reports of activity that appear unusual and arouse suspicion upon closer inspection.

Mechanisms regarding appropriate compliance risk management measures to be applied.

Take appropriate safeguards for the confidentiality and use of information exchanged, including safeguards to prevent information leakage.

Appointment of a Money Laundering Reporter (MLRO).

Sustainably plan training and knowledge building.

Independent test plan to ensure full effectiveness.

Independent audit of the AML/CFT compliance program in Kenya

Just having an AML/CFT compliance program in place is not enough. Programs must be monitored and evaluated by independent audits. In Kenya Financial Institutions (FIs) and DesignatedNon-Financial Business and Professionals (DNFBPS) should regularly evaluate their AML/CFT programs to ensure their effectiveness and look for new risk factors. Those conducting the tests must be sufficiently qualified to ensure that their findings are reliable. For example, but not limited to, an independent review should:

- Evaluate the overall integrity and effectiveness of the AML/CFT compliance program, including policies, procedures and processes.

- Assess the adequacy of the AML/CFT risk assessment.

- Examine the adequacy of CDD policies and procedures and whether they comply with regulatory requirements.

- Review of case management and suspicious activity reporting (STR) systems. This includes survey evaluations and unusual transaction inquiries.

- Evaluate the adequacy of records management and records management processes.

- Track previously identified deficiencies and ensure managers fix them quickly.

How can MemberCheck Help?

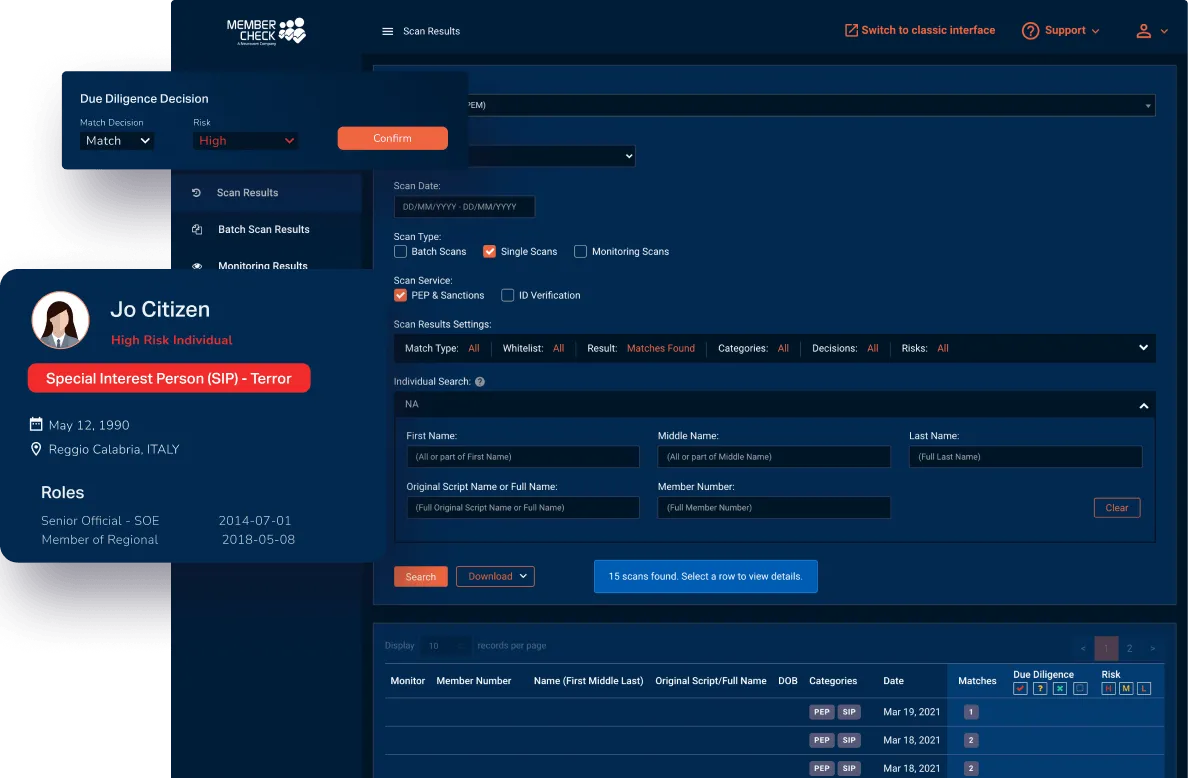

Our clients are provided with a secure and simple solution in regard to scanning for politically exposed or high-risk individuals, as well as checking names against sanction, regulatory, law enforcement, and other official lists.

Use our sophisticated scan filters and due diligence workflow to minimise the amount of time you spend sorting through, false matches. Scan results and reporting sections allow you to access customer details, whenever and wherever required, as well as download reports, to customise for further investigation or to provide evidence of your AML program compliance for auditing purposes.

* This page is intended as general information only and should not be relied on as the sole source of information for your AML obligations and AML program. Please visit your local regulatory authority sites for the latest relevant and full information.