The Proceeds of Crime (Anti-Money Laundering and Anti-Terrorist Financing) Regulations 2008 establishes a series of duties for the obliged entities:

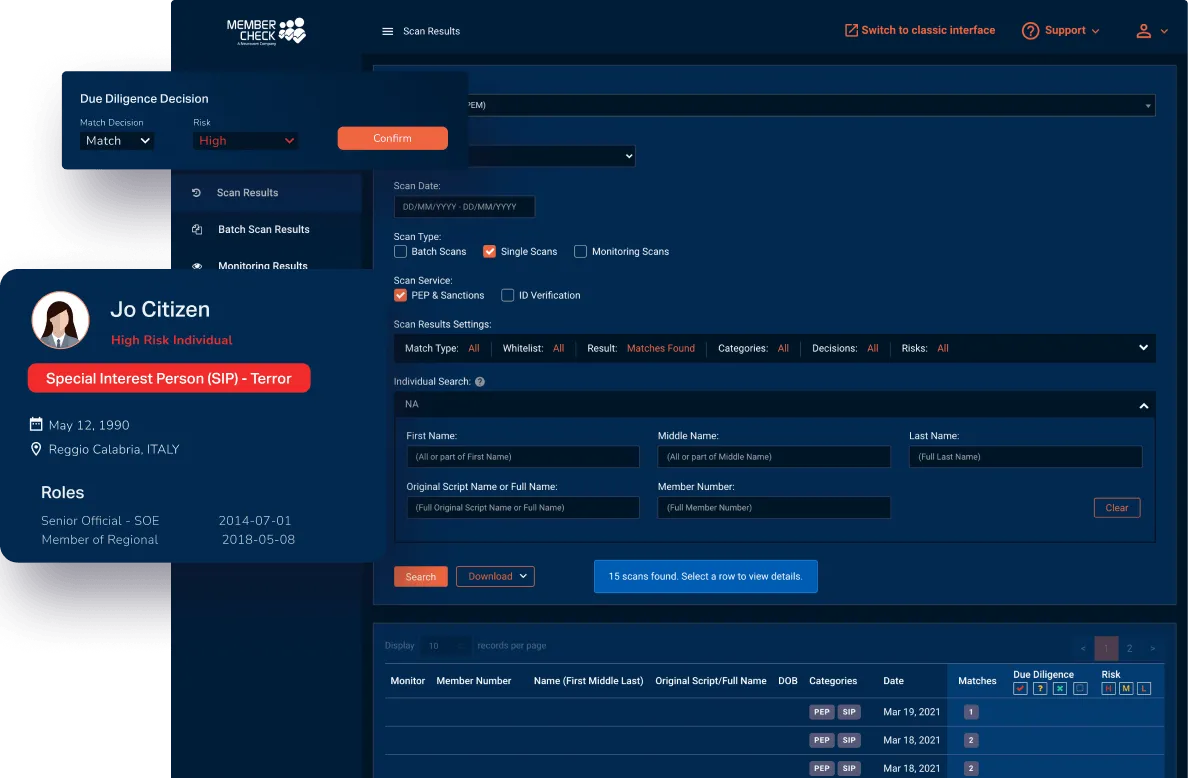

- Duty of applying customer due diligence measures when the entity establishes a business relationship, carries out an occasional transaction, suspects money laundering or terrorist financing or doubts the veracity or adequacy of documents, data or information previously obtained for the purpose of identification or verification

- Duty of ongoing monitoring of a business relationship, meaning:

- Investigation of transactions undertaken throughout the course of the relationship to ensure that the transactions are consistent with the knowledge of the customer, their business and risk profile

- Investigation into the background and purpose of all complex, unusually large transactions, or unusual patterns of transactions which have no apparent economic or lawful purpose

- Keeping documents, data and information obtained for the purpose of customer due diligence measures up to date

3. Duty to keep records of the evidence found on the customers’ due diligence and of the evidence of transactions

4. Duty to establish internal reporting procedures, identifying a Reporting Officer, to which employees can report any information which comes to their attention and could give rise to a knowledge or suspicion that another person is engaged in money laundering or terrorist financing

5. Duty to maintain an independent audit function which must provide and document an independent and objective evaluation of the robustness of the AML/ATF framework, and the reliability, integrity and completeness of the design and effectiveness of the AML/ATF risk management function, including AML/ATF internal controls framework, and the AML/ATF compliance

6. Duty to train employees so they are made aware of the law relating to money laundering and terrorist financing and can recognise and deal with transactions which may be related to money laundering and terrorist financing

7. Duty to designate a Compliance Officer, that shall:

- Ensure that the necessary compliance program procedures and controls required by the Regulations are in place; and

- Coordinate and monitor the compliance program to ensure continuous compliance with the Regulations