AML/ CFT regulations in Argentina determine any obliged entity must comply with the following obligations:

Collect from clients documentation that can be used to prove their identity, legal status, address, and other information that is required in each case in order to carry out the intended operation

Report any suspicious event or operation regardless of the magnitude. Consider suspicious operations to be those transactions that, in accordance with the uses and customs of the activity, as well as the experience and suitability of the persons obliged to report, are unusual, without economic or legal justification or of unusual complexity or unjustified, are carried out in isolation or repeatedly

Refrain from revealing to the client or third parties the AML actions that are being performed in compliance with the law

Risk Evaluation: the probability of the entity being exposed to money laundering should be determined by an examination of the entity's overall control environment, as well as the characteristics of the industry

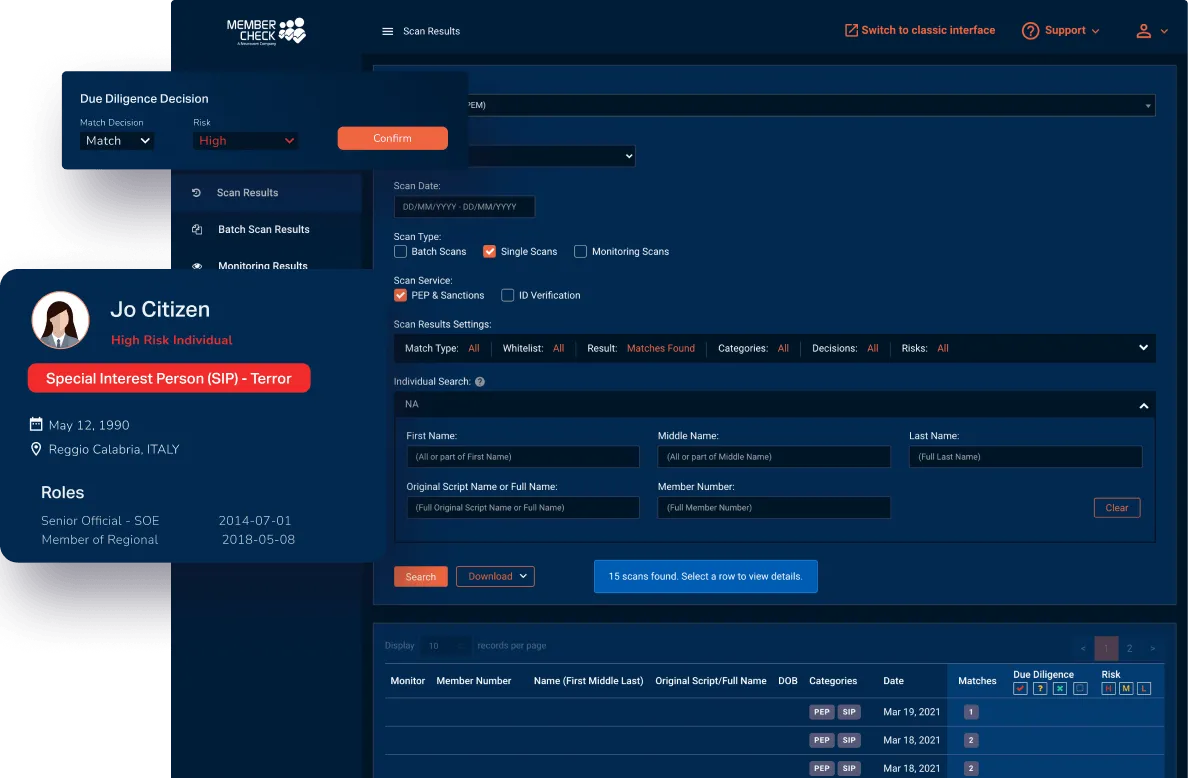

Know Your Customer: maintain up-to-date information in order to understand the client's profile

Monitoring: a framework must be developed that enables the review and control of customer transactions in order to detect irregular and suspicious activity in accordance with the predefined profile

Investigation: ensure that all employees of the organisation recognise the critical nature of adhering to policies and procedures pertaining to the prevention of money laundering and funding of terrorism

Report: the entity's systems must be capable of capturing the information required to comply with regulatory requirements for reporting to various authorities, while maintaining the information's integrity

Audit: there should be a risk-based internal audit strategy in place to demonstrate compliance with the terrorism-related money laundering and funding prevention policy

Awareness training programs should be implemented in the organization in order to raise awareness and promote healthy behavioral habits