Under the 19,574 Law financial and non financial institutions must:

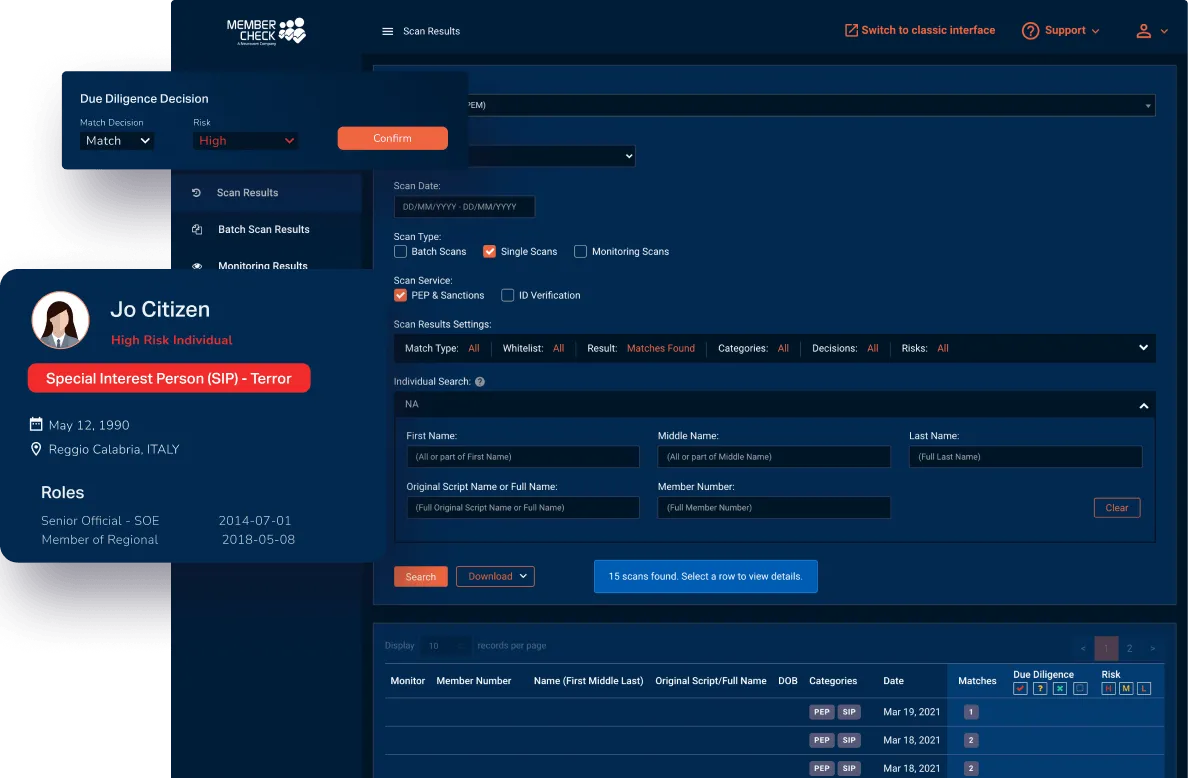

Establish effective customer due diligence systems and monitoring programs

Screen against Office of Foreign Assets Control (OFAC) and other government lists

Establish an effective suspicious activity monitoring and reporting process

Develop risk-based anti-money laundering programs

Have Customer Due Diligence (CDD) Programs

Identify and verify information about customers, using reliable data and information from sources

Determine the final beneficiary's name and take fair actions to check it. The term "final beneficiary" refers to a real individual who holds at least 15% (fifteen percent) of the capital or its equivalent, or of the voting rights, or who has final authority over an entity, whether that institution is a single person, a trust, an investment fund, or some other affectation or legal framework

Obtain information about the purpose of the business relationship and the nature of the businesses to be developed, this should be based on the risk assigned to the client, commercial relationship or type of transaction to be made

Conduct, if possible, regular reviews of the contractual arrangement and transactions to ensure that they are compliant with the facts available from the client's expertise and the risk profile allocated to it, including the source of funds

Report suspicious activity that might signal criminal activity (e.g., money laundering, tax evasion)